International Energy Agency Global Hydrogen Review 2023 includes natural hydrogen for the first time and highlights Helios Aragón’s Monzón Project.

The Earth continuously produces natural hydrogen underground through a series of chemical reactions (oxidation of ferrous iron minerals, water radiolysis, organic matter maturation and outgassing from the Earth’s mantle). A growing number of discoveries of underground natural accumulations of hydrogen have triggered interest in natural hydrogen as a complement to other low-emission hydrogen production technologies. Natural hydrogen presents several advantages: it is an energy source and not an energy vector, thus eliminating the need for fossil fuels and electricity in its production (resulting in reduced emissions and avoiding energy transformation losses). Additionally, production is not subject to intermittency (as in renewable-based production), production sites have a limited land footprint and there is no need for purified water or CO, storage.

However, extracting natural hydrogen requires compression and purification systems since natural hydrogen accumulations contain different impurities (such as nitrogen, methane, CO2, helium and argon) and the hydrogen content can vary widely (2.4-100% in volume) depending on the location, the type of accumulation and the depth. These factors can affect the life-cycle emissions of natural hydrogen production. Initial studies suggest that these can be low (<1 kg CO2/kg H2) but vary over the lifetime of the well (due to reduced well productivity), and can be highly impacted by impurities (particularly methane).

Initial estimates suggest that the Earth’s hydrogen potential exceeds current demand and could even be capable of meeting the growing requirements of decarbonisation scenarios. However, the potential exploitation of natural hydrogen presents challenges and remains highly uncertain. Detailed geological surveys tracking natural hydrogen accumulations are not readily available, impeding a comprehensive understanding of its formation, migration and commercial exploitability. There is a possibility that the resource is too scattered to be captured in a way that is economically viable. While proponents claim lower production costs compared to other methods (in the range of USD 0.5-1/kg H2), such as natural gas, the exact cost implications remain to be seen.

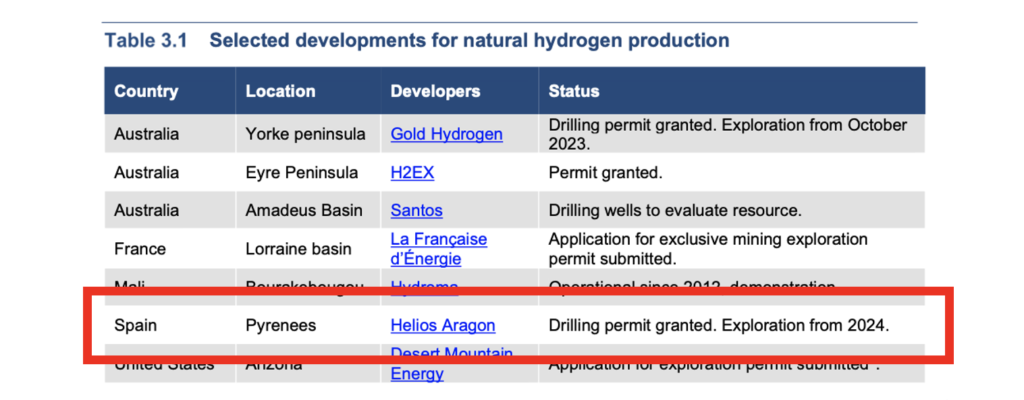

The number of companies engaged in natural hydrogen exploration has significantly increased, with 40 active companies as of mid-2023, compared to only 3 companies in 2020. However, the lack of regulatory frameworks in some countries has slowed down project development, although progress has been made in others, with licensing already happening in Australia, France, Mali, Spain and the United States (Table 3.1). So far, development has been spearheaded by small wildcatters, but some major energy companies have started to show interest in the technology, including Shell, BP and Chevron joining a consortium led by the US Geological Survey and Colorado School of Mines, focusing on studying natural hydrogen.